Child support, a critical aspect of family law, ensures financial stability for children post-separation. Calculations consider parental incomes, time with the child, and unique needs, but complex formulas often lead to common support errors due to income miscalculations, misinterpretation of parenting time, and incomplete financial disclosures. These mistakes cause financial strain and unrest, highlighting the importance of meticulous analysis, clear agreements, regular communication, and accurate disclosures. Failing to account for significant changes in circumstances can further complicate matters. Legal assistance is crucial for navigating appeals and dispute resolution, ensuring fairness, accuracy, and modifications based on life changes or increased child needs, thereby minimizing the impact of common support errors.

Child support legal matters often present complex challenges, with numerous potential pitfalls. From calculating obligations to interpreting parenting time, these processes can be fraught with error. This article explores common issues in child support cases, focusing on critical areas like common support errors, accurate calculation methods, and the impact of parenting time arrangements. Understanding these challenges is essential for both parents navigating these legal landscapes and professionals seeking to ensure fair and just outcomes.

- Understanding Child Support: Basics and Legal Framework

- Common Errors in Calculating Child Support Obligations

- Misinterpretation of Parenting Time and Its Impact on Support

- Financial Disclosures: Omission and Inaccuracies

- Failure to Consider Changes in Circumstances

- Navigating Appeals and Dispute Resolution Processes

Understanding Child Support: Basics and Legal Framework

Child support is a crucial aspect of family law, ensuring that children receive financial care from both parents after separation or divorce. Understanding child support involves grasping several basic concepts and navigating within a legal framework designed to protect the interests of the child. The primary goal is to establish a fair and reasonable amount that contributes to the child’s well-being and covers essential needs such as food, clothing, housing, healthcare, and education.

The legal framework for child support varies by jurisdiction but generally involves calculating the support amount based on factors like parents’ income, time spent with the child, and the child’s specific needs. Common issues in child support legal matters often stem from errors in these calculations or misunderstandings about parental responsibilities. These include miscalculations of income, incorrect application of guidelines, disparities in parenting time, and disagreements over special expenses. Addressing such common support errors requires careful analysis, clear communication, and sometimes the assistance of legal professionals to ensure that every aspect of child support is determined accurately and equitably.

Common Errors in Calculating Child Support Obligations

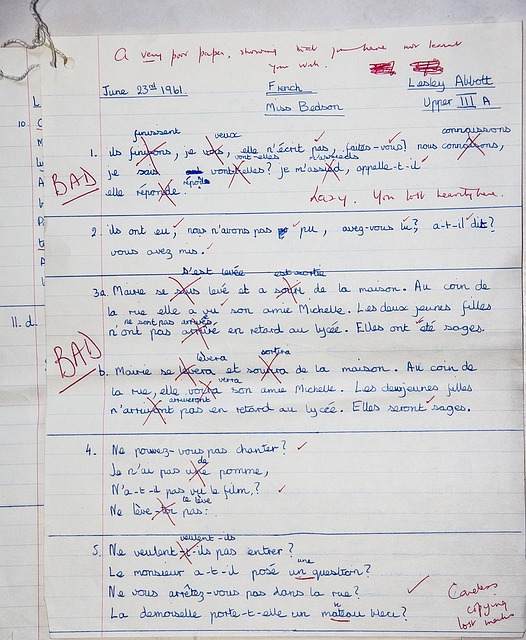

In many child support legal matters, a recurring issue is the calculation of obligations, leading to common support errors. These mistakes often arise from complex formulas and variables involved in determining the financial burden on either parent or both, depending on custody arrangements and income levels. The most frequent errors include miscalculating the base income, failing to consider all relevant deductions and adjustments, and incorrectly applying state-specific guidelines for calculation.

Such support errors can significantly impact the lives of families involved, causing financial strain and unrest. They may result from a lack of understanding of legal requirements, changes in financial circumstances, or simply human oversight. To avoid these common pitfalls, parents and legal professionals alike must remain vigilant, meticulously reviewing calculations and staying informed about any updates to child support laws and guidelines.

Misinterpretation of Parenting Time and Its Impact on Support

In child support legal matters, one of the most common issues is the misinterpretation of parenting time, which can significantly impact the financial obligations and arrangements for both parents. The concept of “parenting time” often refers to the schedule that outlines when each parent has physical custody of the children. However, misunderstandings or differing interpretations of this schedule can arise, leading to disputes and errors in support calculations. For example, one parent might believe they are entitled to more time with the children than agreed upon, resulting in claims for increased support based on perceived additional expenses during their care.

This misinterpretation can create a cycle of legal back-and-forth, causing delays and increased costs for all involved parties. It’s crucial for parents and legal professionals alike to have clear, consistent, and well-documented parenting time agreements to avoid these common support errors. Regular communication and ongoing clarification are essential to ensure both parents understand their responsibilities and obligations regarding child support and parenting time.

Financial Disclosures: Omission and Inaccuracies

Financial disclosures play a crucial role in child support cases as they provide a clear picture of each parent’s financial situation. However, one of the most common issues is the omission or inaccuracy of these disclosures. Parents may intentionally or unintentionally leave out certain income sources, investments, or assets, leading to an incomplete financial picture. This can result in unfair decisions, as the court cannot accurately calculate child support when all relevant information is not provided.

Inaccuracies can also arise from simple human error or a lack of understanding of financial reporting requirements. For instance, miscalculating income due to inconsistent paychecks or overlooking self-employment income can skew the financial disclosures. Such errors may cause delays in the case and lead to further complications, ultimately affecting the well-being of the child involved.

Failure to Consider Changes in Circumstances

In many child support cases, a frequent mistake made by parents and legal professionals alike is failing to account for significant changes in circumstances. Life is dynamic, and financial situations can shift dramatically over time due to various factors such as job loss, increased medical expenses, or a parent’s return to education. These alterations can have profound impacts on a family’s financial stability, yet they are often overlooked when determining child support payments. Such omissions can result in unfair arrangements that may not adequately provide for the child’s needs or cause undue strain on the supporting parent.

To avoid these common support errors, it is imperative to stay vigilant and proactive in monitoring changes. Regularly updating financial disclosures and ensuring all relevant information is presented to the court can help achieve a more accurate and just outcome. Parents should also foster open communication with their ex-partners to mutually agree on adjustments when circumstances change, promoting a collaborative rather than adversarial approach to child support matters.

Navigating Appeals and Dispute Resolution Processes

Navigating appeals and dispute resolution processes is a significant aspect of child support legal matters, as it’s one of the most common support errors encountered. Parents involved in these cases often face complex procedures, requiring careful consideration of various factors to ensure fairness and accuracy. Missteps in this navigation can lead to unfavorable outcomes, exacerbating an already emotionally charged situation.

Effective dispute resolution demands a thorough understanding of legal rights and responsibilities. Many common support errors arise from misunderstandings or misinterpretations of court orders, child support guidelines, and related legislation. Adequate representation through experienced legal counsel is crucial, as they can guide parents through appeals, mediate settlements, or advocate for modifications to support arrangements based on life changes such as job losses, relocation, or increased needs of the child.